Radio | News week in plain Finnish | Saturday 15.11.2025

Income and taxes of Finns

Listen

You can read the news simultaneously below.

Tax information

The topic of the news week is the income and taxes of Finns.

This week, last year’s tax data was published in Finland. Many media outlets reported how much Finns earned and paid in taxes.

We will now tell you more about who had the highest income, which companies paid the most taxes, and why tax information is published in Finland.

Open image viewer

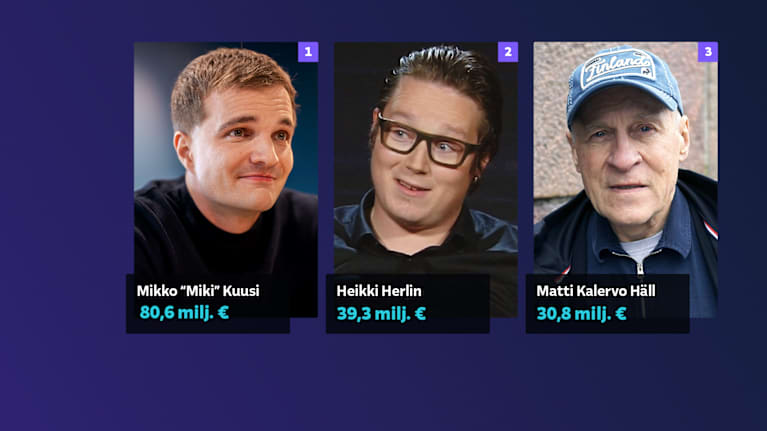

The three highest-earning Finns last year were Miki Kuusi, Heikki Herlin and Matti Häll. Photo: Petteri Bülow / Yle, Yle archive, Vesa Moilanen / Lehtikuva

The three highest-earning individuals

The highest-earning person in Finland was again Miki Kuusi.

Kuusi is the founder of food delivery company Wolt and the CEO of food delivery company DoorDash. He earned over 80 million euros in revenue last year.

The second highest-earning person was Heikki Herlin, whose income was approximately 39 million euros.

Third place went to Matti Häll, whose income was almost 31 million euros.

Women and men

Among high-income earners, women’s and men’s incomes were closer to each other than before. This means that the income gap between men and women narrowed.

One of the highest-earning women was Riikka Herlin, who had an income of almost 24 million euros.

He belongs to the well-known Herlin family and is involved in many companies and foundations.

Income over 150,000 euros

Last year, there were almost 38,300 people in Finland with an income of over 150,000 euros.

Most of them were men, but the number of women also increased clearly from the previous year.

Most high-income earners are over 50 years old.

Regionally, the highest number of high-income earners is in Uusimaa.

Open image viewer

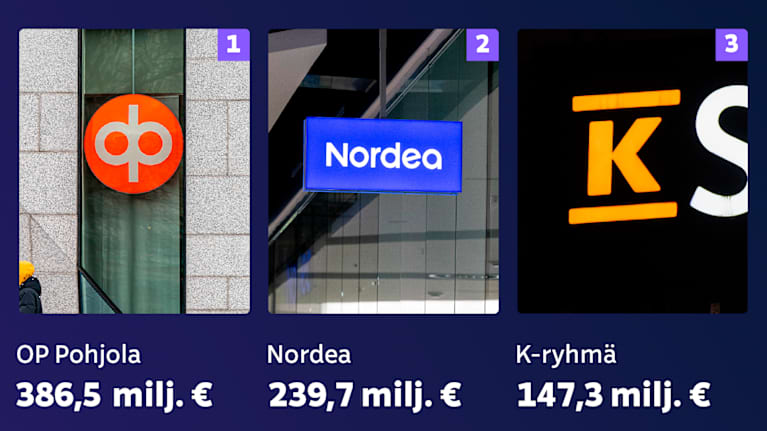

The OP Bank Group, Nordea and K Group paid the most corporate tax. Photo: Asmo Raimoaho / Yle

Companies

In corporate taxation, banks were again the largest tax payers.

The largest payer was the OP Bank Group, which paid almost 387 million euros in corporate tax.

Nordea also paid a lot of taxes.

Next on the corporate tax list are the large trading companies K-Group and S-Group. S-Group also has banking operations.

The surprise was that the energy company Neste did not pay any corporate tax last year because Neste made a loss.

Transparency

Tax information is published in Finland for the sake of transparency.

When tax information is public, people can discuss taxation and how income and taxes are distributed.

People can evaluate the income of decision-makers and leaders, as well as the salaries of companies and society.

Transparency of tax information increases trust in society and helps monitor how tax funds are used.

Open image viewer

Transparency of tax information increases trust in society. Photo: Jani Aarnio / Yle

Repetition

The topic of the news week was Finns’ income and taxes.

The highest-income person in Finland last year was again Miki Kuusi. Of the companies, the OP Bank Group paid the most tax.

This was a news week in plain Finnish. See you again, let’s hear from you!