Radio | News week in plain Finnish | Saturday 26.4.2025

Government tax cuts

Government tax cuts

The topic of the news week this time is the government’s tax cuts.

The government held a mid-term meeting this week. It was a meeting where the government decided on the state’s financial plan for 2026-2029.

The government decided to make a lot of tax cuts. They will be financed by savings and some tax increases.

We will now tell you more about the government’s mid-term decisions.

Labor tax credits

The government has decided on a big tax cut for employees and companies. The aim is to accelerate economic growth.

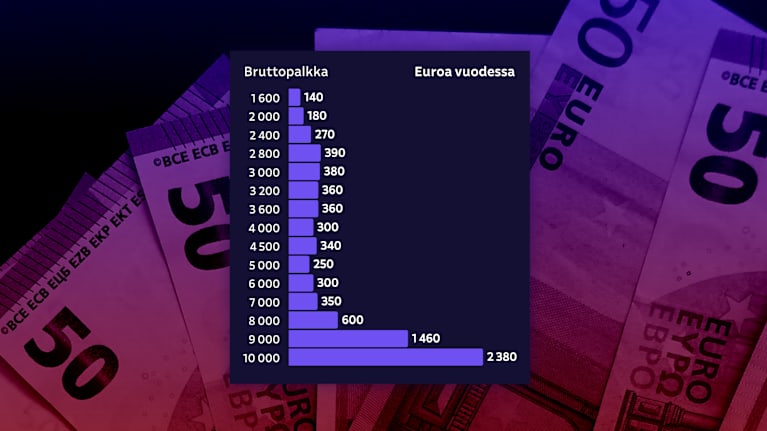

Taxation on labor will be reduced by approximately one billion euros over the next year and the following year.

For example, if a person’s salary is 3,000 euros per month, they will have about 380 euros more money per year than they have now.

The child allowance for tax deductions will be increased by 100 million euros. This will reduce the tax burden on families with children.

Taxation on large annual incomes of over 100,000 euros will also be significantly reduced.

Corporate tax breaks

Corporate tax for companies is being calculated.

The purpose is to support entrepreneurship and the operations of companies. The purpose is to attract foreign investments into companies in Finland.

Corporate tax is a tax that companies pay on their profits.

Corporate income tax will decrease from 20 percent to 18 percent in 2027. The change is significant. It will reduce tax revenues by 830 million euros.

The intention is that tax revenue will increase later if investments come to Finland and the economy improves.

The calculation of corporate income tax also attracts criticism.

Economics professor Jarkko Harju says that the corporate tax cut may not increase investments in Finland.

This is what studies on Finland’s previous tax reforms show.

Tax increases and savings

Tax cuts for labor and companies are financed by savings and some tax increases.

For example, taxes on soft drinks, nicotine pouches and e-cigarettes will be increased by 80 million euros.

The right to deduct trade union membership fees from taxes will end.

Development cooperation funding is being cut.

Basic funding for higher education institutions will be reduced.

Repetition

The topic of the week’s news was the government’s tax cut, which was decided on in the mid-term elections.

In particular, taxation of labor and companies will be reduced. The aim is to support economic growth and the operations of companies.

The changes to taxation are significant. They will be financed through savings and increases in some taxes.

This was a news week in plain Finnish. See you again, let’s hear from you!